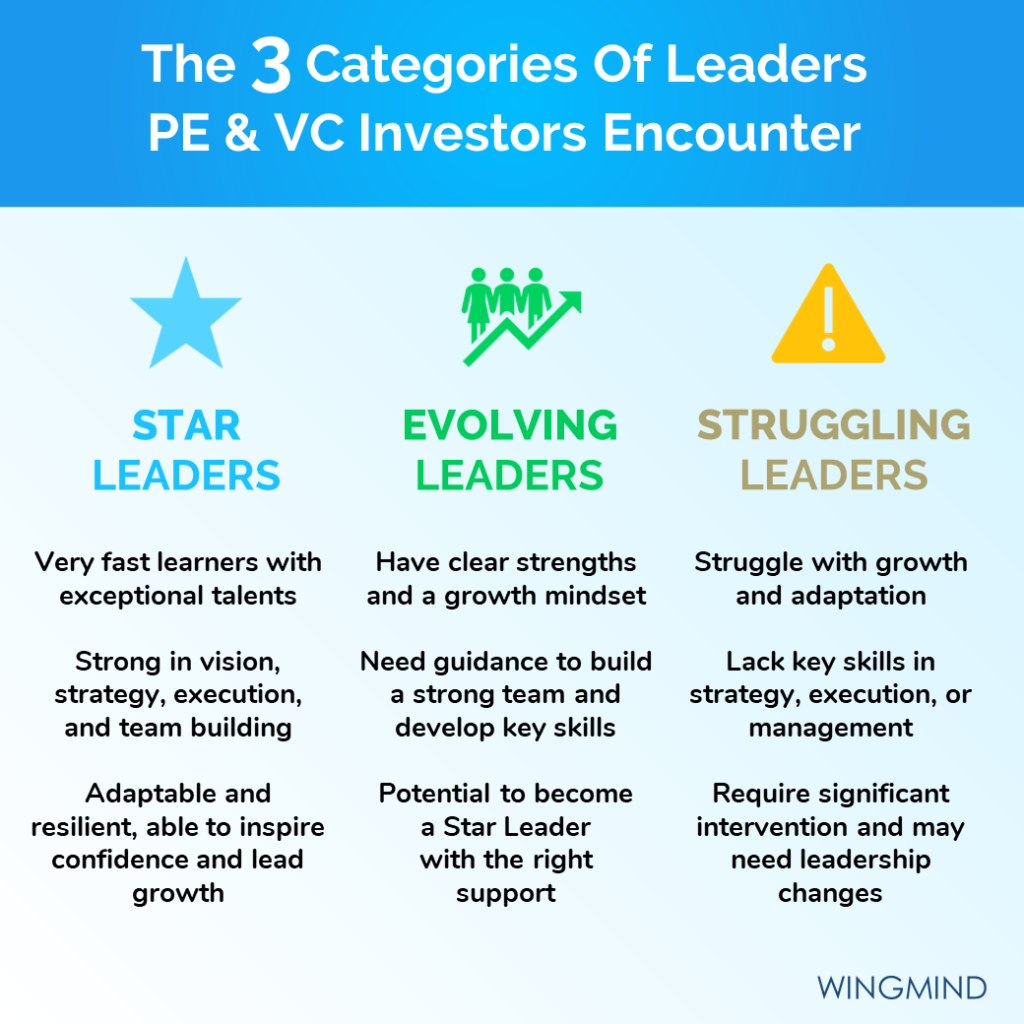

In venture capital (VC) and private equity (PE), the people behind the business are just as important as the business itself. Investors are not just backing products, markets, or strategies—they are placing their trust in the founders and leadership teams who will execute on those ideas. This is why assessing founders is crucial for understanding if they have what it takes to elevate the company to the next level and, more importantly, how investors can support them in realizing their potential. Here are the three types of leaders VC and PE investors typically encounter, along with strategies for supporting each type:

1. Star Leaders

Who They Are:

Star Leaders are the complete package. These founders or leaders excel across the board, possessing strengths in vision, strategy, execution, and team building. Adaptable and resilient, they demonstrate a deep capacity to guide their business through the inevitable challenges that come with growth. Star Leaders are fast learners, capable of quickly mastering new skills and navigating complex business landscapes. Their leadership inspires confidence in both the team and investors, setting a strong tone for the company’s culture.

Why They Stand Out:

These leaders excel not only because of their innate talent but because they understand the importance of integrating their vision with practical execution. They are skilled at making strategic decisions while ensuring their teams are aligned and motivated. Investors hope to find these leaders, but they are rare.

VC/PE Strategy:

The best way to support Star Leaders is by providing the resources and strategic advice they need to accelerate their vision. They often know how to scale the business themselves but can benefit from additional expertise in specific areas, such as international expansion, M&A, or advanced financial structuring. Star Leaders don’t need micromanagement—they need resources that help them move faster and smarter.

2. Evolving Leaders

Who They Are:

Evolving Leaders show clear strengths but are still in the process of becoming fully-rounded. They may excel in one or two areas—whether it’s vision, product, or sales—but may lack other skills crucial for scaling the business. Evolving Leaders are works in progress, and their ability to grow and surround themselves with complementary leadership teams will ultimately determine their success.

Why They Stand Out:

With the right guidance and mentorship, Evolving Leaders have the potential to become Star Leaders. However, they also face the risk of drifting towards underperformance if their growth challenges are not adequately addressed. These leaders can become Star Leaders or Struggling Leaders depending on the level of support and self-awareness they possess.

VC/PE Strategy:

To help Evolving Leaders reach their full potential, investors should provide coaching, mentorship, and assistance with recruiting key leadership positions that complement their strengths and cover any gaps. Building a solid leadership team around them is crucial, as is encouraging a culture of learning and adaptability. Evolving Leaders need guidance to sharpen their leadership capabilities and to avoid stagnation as the company grows.

3. Struggling Leaders

Who They Are:

Struggling Leaders are founders or executives who lack critical skills or face significant weaknesses that could seriously hinder the company’s growth. These leaders often struggle with operational execution, strategic decision-making, or team management, creating bottlenecks that can prevent the business from scaling. Their leadership gaps pose significant risks to the company’s future.

Why They Struggle:

Struggling Leaders often have difficulty adapting to the rapid changes a growing business demands. Whether it’s due to a lack of experience or an inability to manage the complex dynamics of leading a scaling company, they risk stunting the company’s growth if their challenges aren’t addressed. Without significant intervention, these leaders may lead the business into crises that can be difficult to recover from.

VC/PE Strategy:

The first step is to determine if the Struggling Leader can grow into their role with the right support, or if external leadership is required to safeguard the company’s future. If the leader shows potential for growth, a robust development plan—including coaching, strategic guidance, and team restructuring—should be put in place. In more critical situations, it may be necessary to replace the founder or bring in an experienced CEO to stabilize the company and guide it through the next stage of growth.

VC and PE investors are not just investing in businesses—they are investing in people with potential. By carefully assessing founders and leadership teams, investors can identify the strengths, weaknesses, and growth potential of those they are backing. Understanding which type of leader you are dealing with—Star, Evolving, or Struggling—allows for tailored support that maximizes their impact and ensures the long-term success of the company.

At WINGMIND, we specialize in HR Due Diligence for PE/VC investors, offering leadership assessments that uncover potential risks and growth opportunities.

Founder of WINGMIND, David Chouraqui serves as an advisor and coach for leaders and management teams. His areas of expertise include HR audits, leadership assessments, and change management.